How’s this story from a HAPPY SUBSCRIBER

Case Study 3:

Existing client made an Investment with PNC Investments, his business bank, as they were after him to use their investment services because he was such an “Important Client”. Client met with their PNC advisors and went through the process of understanding risk and return and wound up with a portfolio that was essentially a 60/40 Stock Bond Portfolio. This is your typical portfolio that JUST ABOUT EVERYONE winds up with. The client invested $50k initially and another $50k to bring the total deposit to the account to $100k.

The client made ZERO additions or withdrawals once the account reached $100k and the made NO REQUESTS of the advisor for any special treatment or adjustments to their recommendations.

Client shared his latest quarterly report from PNC which encompassed the prior 3 YEAR period. During the 3 year period of 4/1/21 through 4/1/24, the S&P500 Index rose a cumulative 36.91% including dividends. Adjusting for the split deposits by the client, we estimate that the cash flow of the account would have created an adjusted index return of approximately 25% over that same period.

Now we would NEVER expect that a 60/40 portfolio would ever come close to matching the S&P500 index and accordingly we would expect the portfolio to have achieved a CUMULATIVE return of approximately 65% of the S&P500 return over that time frame or +/- 16.25% BEFORE FEES PNC charged fees for those 3 years, they’re entitled it is a business after all so those fees will reduce the expected return so we’d guess they’d lower the expected return from 16.25% to +/- 13% or so. (SEE? FEES MATTER)

The quarterly report that the CLIENT sheepishly presented us tells the whole story:

CLIENT Time Weighted Rate of Return (TWRR) NET OF ALL FEES, WAS ….. 0.08%

Yes, that is 8 basis points or .08 percent.

For a 3 year period where the S&P500 was up 25%

We at Smart Structure are REALISTS, we don’t expect perfection from anyone and therefore only report the facts as we see them. Therefore when the Client sheepishly shared his quarterly report with us, we merely said

“WE TOLD YOU SO” .

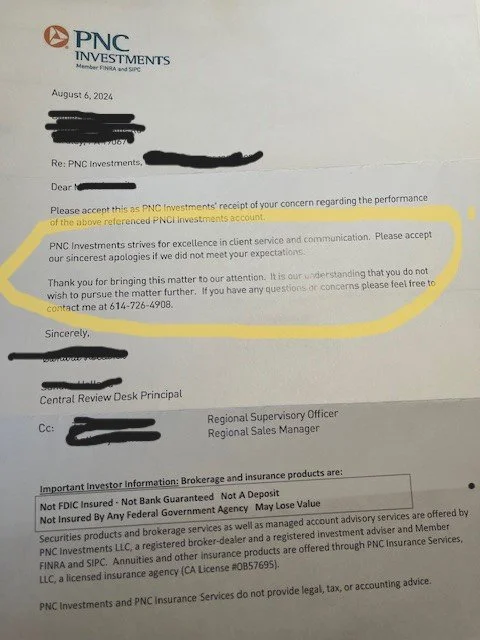

This would be funny in an of itself, but the kicker, especially to the client was this: AFTER they hounded him for additional business and, when he finally spoke with them to express his displeasure at such a paltry performance over such a long time, THEY HUNG UP ON HIM and sent this letter.

Now PNC is NO DIFFERENT than any other of the big advisory firms. Don’t think I’m singling them out. They ALL sell the same “One Size Fits All” solution. Stop wasting Time and Money!

It is TIME for you to get SMART!!