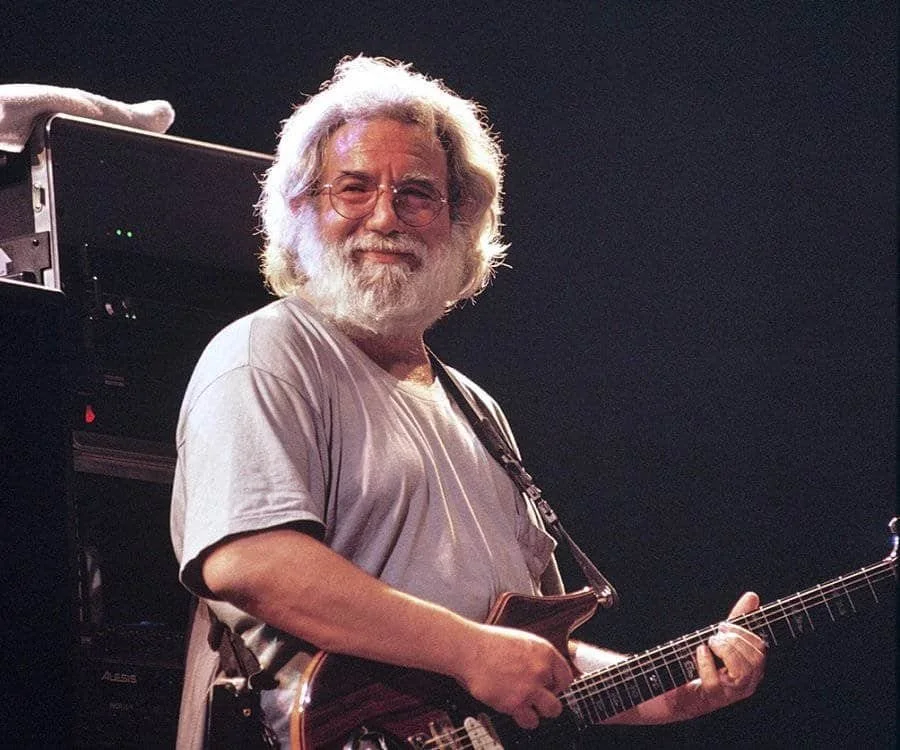

Once in a while you can get shown the light …

The STORYTELLER makes no choice, soon you will not hear his voice ..... His JOB IS TO SHED LIGHT, BUT NOT TO MASTER!

As the Great Jerry Garcia sang so eloquently, “Once in a while you can get shown the light in the strangest of places of you look at it right ..”

WHY YOUR GOALS DON’T MIRROR WALL STREET’S GOALS:

YOU WANT FREQUENT SUCCESS - LIKE A GOOD BATTING AVERAGE

“YOU” WANT TO LIMIT/AVOID BAD YEARS!

SO BECAUSE YOU’RE SMART -

YOU SHOULD DO THE FOLLOWING:

1) CONTROL YOUR EXPENSES!

STOP PAYING FOR ADVICE SERVICES BASED ON YOUR ASSET SIZE

2) DEFINE AND CONTROL YOUR RISK EXPOSURE

3) BEAT THE MARKET EVERY YEAR USING A FUNGIBLE EFFICIENT SOLUTION

4) PERIODICALLY RESET ALLOCATION - BOOK GAINS/LOSSES

to ENSURE BEST Tax treatment.

LTCG RATES ARE LOWEST YOU CAN PAY - SO LOCK IN LOW TAX RATE AND RESET

5) Make NEW ALLOCATION using SSIM analysis - MINIMIZE RISK - MAXIMIZE RETURN!

RESET, ENSURE THAT YOUR RISK REWARD STAYS CONSTANT,

INCREASE FUNGIBILITY AND

CONTINUALLY IMPROVE YOUR WORST CASE SCENARIO!

6) REPEAT.

WALL STREET WANTS MAGNITUDE OF SUCCESS - LIKE SLUGGING PERCENTAGE

WALL STREET DOESN’T CARE ABOUT BAD YEARS!!

THEY GET PAID TO GAMBLE WITH YOUR MONEY

WALL STREET BANKS ON THE FACT THAT:

1) That a typical investor holds many different investments.

2) That new investments ARE CHOSEN BY LAST YEAR PERFORMANCE MORE THAN ANYTHING ELSE!

3) That once chosen, a fund will be kept for a period REGARDLESS OF THEIR PERFORMANCE.

4) That YOU DON’T READ SPIVA or IFA REPORTS WHICH SHOW THAT:

VERY FEW FIRMS CONSISTENTLY BEAT THE MARKET OVER SHORT TERM

AND NO ONE BEATS IT CONSISTENLY OVER 3, 5 AND 10 YEARS!

5) They DON’T CARE ABOUT YOUR RISK EXPOSURE, YOUR TAX SITUATION AND CHARGE FEES ON ASSETS THAT YOU WILL LOSE WHEN YOU PAY TAXES AND THEY GET PAID MORE BASED ON ASSET SIZE -

SO THE MORE YOU BRING THEM,

THE MORE THEY CHARGE YOU!

EXAMPLE OF SPIVA DATA