The greatest myth ever told.

Asset allocation, a cornerstone of investment strategy, traces its roots back centuries, evolving with the changing landscape of finance. The approach gained prominence in the mid-20th century, championed by luminaries such as Harry Markowitz and William Sharpe, who developed portfolio theory and the Capital Asset Pricing Model (CAPM).

By diversifying investments across different asset classes, investors aimed to mitigate risk and optimize returns, laying the foundation for modern portfolio management.

There’s only one problem… It doesn’t work! (In fact, it can’t!)

The issue isn’t that asset allocation is wrong or bad, it’s that unprovable asset allocation is nothing more than a guess about what may happen tomorrow, often marred by its inherent limitations. While diversification MAY cushion against downside volatility, it ALWAYS limits your upside volatility.

Think about it, when you hold MORE than one asset, you’re almost certain to have two different returns in each asset. Therefore, one of the two assets was a better choice than the other and your return will be an amalgam of those two asset’s returns (lower than the BEST performing return).

What happened yesterday, while factual, does not guarantee how those specific assets will behave in the future.

Asset classes don't always move in tandem, yet they MAY, like 2022, when the S&P and Bonds both moved dramatically downward at the same time.

To those holding ETF’s or mutual funds, your asset allocation did little to protect against downward volatility—BUT HISTORY SAYS IT SHOULD HAVE!

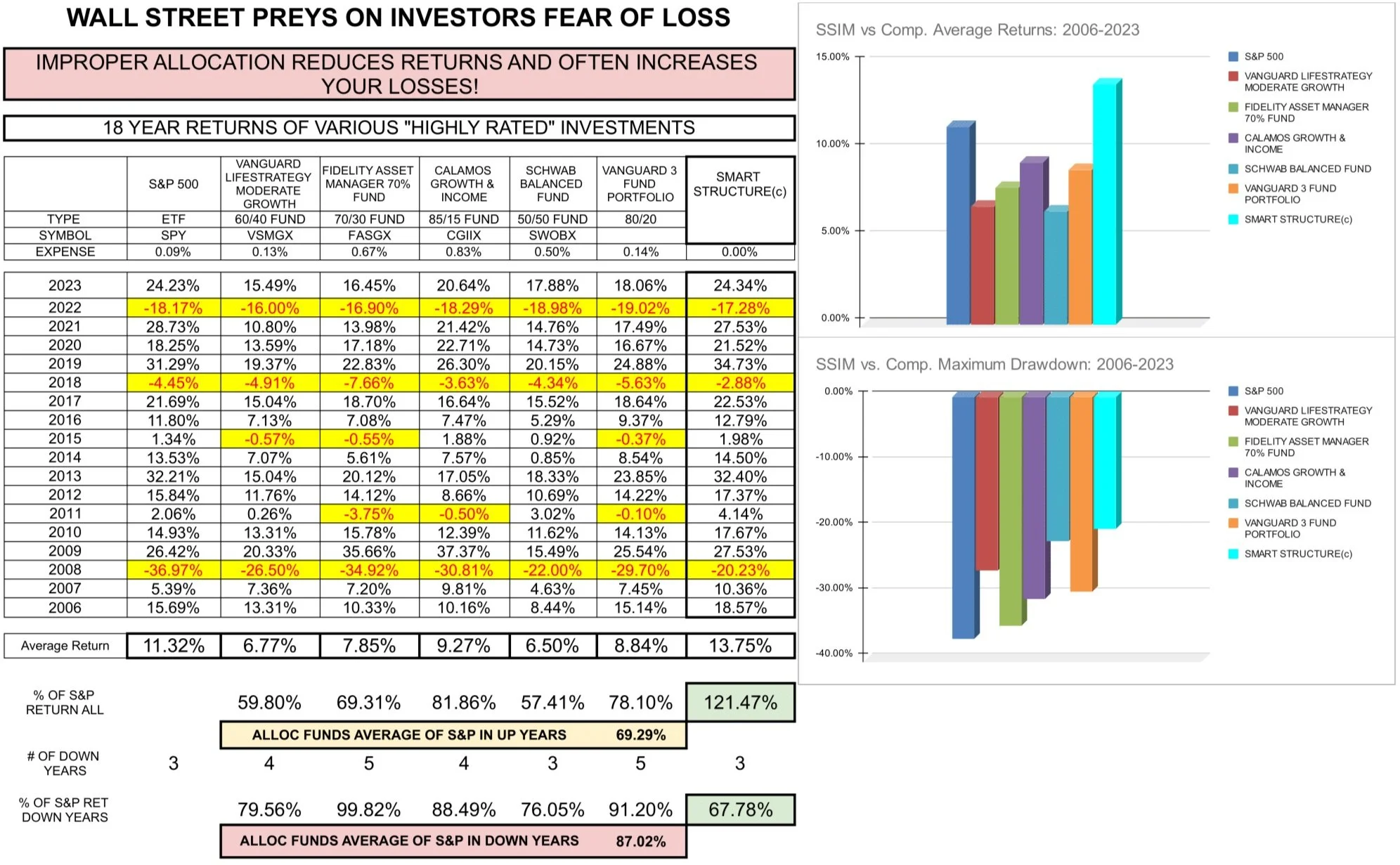

Smart Structure vs. Competitors: 2006 - 2023

“If [it] doesn’t work just once, then [it] DOESN’T work.” —Richard Feynman

So, we won’t tell you NOT to asset-allocate.

WE say: Do it correctly.

Make it a provable solution. Make it an asymmetric investment.

STOP guessing!

Stop wasting your time and money!

We’ll show you the way!